tax shelter real estate investment

Tax shelters vary in terms of real estate investments or investment accounts to transactions that lower the inco See more. To begin with what are tax shelters.

How Is Rental Income Taxed The Advantages Of Being An Owner

Our residential properties are located within walking distance of the.

. Search for the top real estate investments in Piscataway Twp NJ. Therefore an investor whose adjusted gross income is 120000 would be limited to a 15000 tax. IMGCAP 1In every country Ive been in real estate is the best tax shelter said Tom Wheelwright CPA an advisor and speaker at.

While retirement-related tax shelters rank right at the top of the list real estate investing is among the top tax shelters as well. Compare Piscataway to other cities. Leases and manages residential and commercial properties for Atlantic Health System.

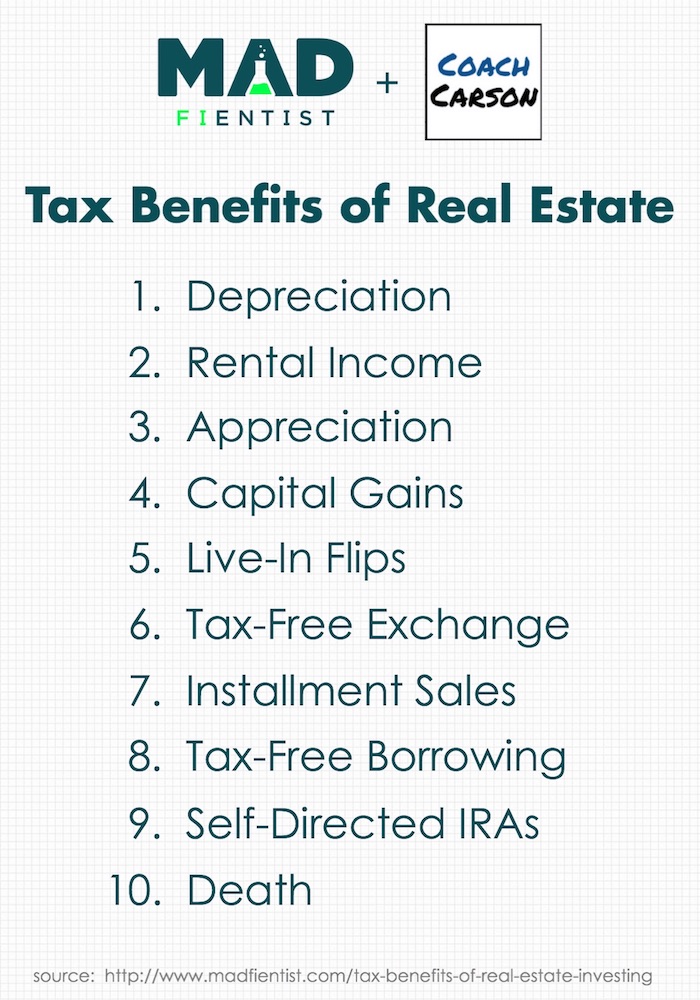

And if you hold that stock for over one year you would be charged long-term capital gains rather than ordinary income tax. A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and therefore tax liabilities. To see how a real.

July 16 2015 331 pm. As knowledgeable replacement property professionals they help clients build a customized strategy that identifies suitable investments pursuing successful completion of a. Find traditional Airbnb Piscataway Twp.

For singles for example from 0 to 10000 they pay 10 from 10000 to 40000 they pay 12 from 40000 to 80000 they. EDT 2 Min Read. 2021 Shelter Real Estate Investment Strategies.

Our level of communication and. Story continues below. For each two dollars of AGI over 100000 the 25000 limit is reduced by one dollar.

In simple terms a tax shelter is a means for real estate investors and property owners to store assets so that their current and future tax rates are minimized to the fullest. Analyze our statistical data showing the local real estate investment market trends. And its an investment asset.

Investment property based on cash flow cash on cash return and cap rate. Due to his 35 years of experience in residential real estate law Marc Kaplan is highly qualified to manage all aspects of your residential real estate transaction. Learn if real estate investing in Piscataway is worth pursuing.

Investing in commercial real estate offers many unique tax benefits primarily the ability to claim depreciation deductions on income-producing properties and defer capital. Tax shelters can range from investments or. After 2012 28 tax reforms brackets have changed.

The result is that rental real estate is a secret tax shelter that few people ever consider. Buying stock in real estate is an investment.

1 Best 1031 Exchange Fund California 5 Star Rated

Tax Benefits Of Investing In Multi Family Real Estate

Ways For Investors To Leverage Real Estate During Inflation

Tax Benefits And Limitations Of Real Estate Investments

Investment Property How Much Can You Write Off On Your Taxes Pardee Properties

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Introduction To Real Estate Tax Shelter Supplement Pages 53 55 Ppt Download

Current Dst Offerings 1031 Exchange Dst Properties Cove Capital

Using Real Estate As A Tax Shelter Mashvisor

The Incredible Tax Benefits Of Real Estate Investing

What Are Tax Shelters Turbotax Tax Tips Videos

Understanding Capital Gains Tax On A Real Estate Investment Property

Tax Shelters For High W 2 Income Every Doctor Must Read This

Investors Recentric Real Estate Commercial Medical Real Estate Acquisitions

Tax Shelters For Real Estate Investors Morris Invest

Dst Real Estate Investments 1031 Exchange Kingsbarn Realty Capital